Contents

Cryptos use advanced coding to make all transactions and data completely secure and safe. For example, let’s say you bought Bitcoin with $10,000 in 2017. Your Bitcoin grew to $60,000, and you decided to use it to buy a Tesla.

Below, we’ll break down every part of cryptocurrency—from blockchain to exchanges—to help you buy crypto in Canada. Cryptopedia does not guarantee the reliability of the Site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any mercatox exchange reviews Cryptopedia article are solely those of the author and do not reflect the opinions of Gemini or its management. A qualified professional should be consulted prior to making financial decisions. You should exploit the direction of the trend you identify by placing a trade in that direction.

Thousands of traders pay tribute to this user-friendly and useful software. Usually offer several pairing options, which gives you the chance to choose a pairing based on currencies you already possess. For example, if you own BTC, then you can trade with any pairing listed on an exchange that includes BTC. Currency hedging is similar to insurance, which you buy to protect yourself from an unforeseen event. Currency hedging is an attempt to reduce the effects of currency fluctuations on investment performance.

Blockchain is a digital ledger

You’ll pay trading fees to the CEX, and you can often store your crypto directly on the platform itself. Centralized exchanges are the most popular form of trading cryptocurrency in Canada. From hodling Bitcoin to buying and selling crypto on an exchange, crypto investing requires us to learn a lot of technical stuff fast. With this incredible new step-by-step guide, investing pro and TV personality Kiana Danial shows you exactly how to understand and take advantage of foreign currency trading.

This would be of immense use in being able to look beyond the accepted truths of forex trading and recognize the true pulse of the market, thus providing the reader with the key to success. A crypto exchange is a digital marketplace where buyers and sellers can meet and trade different types of cryptocurrencies. Many exchanges will allow you to trade the Canadian dollar for crypto or one type of crypto for another. In exchange, you’ll often get higher security measures , access to performance charts, and 24/7 customer service. You must understand that Forex trading, while potentially profitable, can make you lose your money. The author will explain how to choose your broker and what currency pair you should start with.

While exchange rates fluctuate from year to year, the impact of currency on investment returns tends to decline over time. That said, the rapid development of exchanges, payment cards, and regulations have made cashing out or trading crypto increasingly easier. Perhaps the most popular option, mobile wallets are smartphone apps that help you access your crypto from any mobile device. These wallets are often instrumental in helping investors buy goods at retail stores where cryptocurrency is accepted. Unlike a physical wallet, crypto wallets don’t store cryptocurrencies themselves.

They’re called “centralized” because the platform acts as an intermediary, or middleperson, bringing various crypto enthusiasts together. This has been provided by RBC Global Asset Management Inc. and is for informational purposes only. It is not intended to provide legal, trade99 review accounting, tax, investment, financial or other advice and such information should not be relied upon for providing such advice. RBC GAM takes reasonable steps to provide up-to-date, accurate and reliable information, and believes the information to be so when provided.

A base currency is a way to denote an agreed-upon value of different assets. Base currencies are a common tool for comparing exchange rates across fiat currencies in different countries. An American traveling to Italy will want to convert USD into the Italian currency, the Euro.

Official site of Canada’s largest stock exchange and TSX Venture Exchange. Includes investment basics and information on investor protection. Find clear, unbiased answers to your investing questions with this accessible website.

We are constantly searching for a best forex book that can be especially useful for a currency trader. We will select absolutely the best forex book to be featured here. Track and journal trades for your demo and live accounts from any Metatrader broker. Using strategies helps you define each trade by its specific criteria like trade rules, timeframes to trade, and money management. Automated trading journal See how convenient it is to journal your trades with Forexbook. Mark Douglas, a trader, personal trading coach, and industry consultant since 1982 sends the message that “thinking strategy” will profoundly influence a trader’s success rate.

Over $6 trillion changes hands in the foreign exchange market every day. You can jump straight into the action with expert guidance from the hands-on Currency Trading for Dummies. You’ll learn how the foreign exchange market works, what factors influence currency values, and how to understand financial data. You’ll also find details on the latest trends in currency trading, including currency ETFs, cryptocurrencies, and currency options. There are so many different methods of trading found in this book, that you are bound to find something that fits your own personal style.

To hedge an investment, investment managers will set up a related currency investment designed to offset changes in the value of the Canadian dollar. In general, currency hedging reduces the increase or decrease in the value of an investment due to changes in the exchange rate. It’s logical that you will need money to maintain open positions. Once you have set the desired levels, click the «Modify» button at the bottom of the screen. This button will be highlighted only when valid stop loss and/or take profit levels have been entered .

Accessibility

Many Canadians may overlook the financial protection they receive from the CDIC. When you store money in a bank — or purchase a GIC — the CDIC insures up to $100,000. That means, even if the bank fails, you’ll still have access to at least $100,000 of your deposited funds. Look for a crypto exchange with 24/7 customer service and an excellent reputation for answering questions. No one wants to be locked out of their account or stuck wondering where their crypto went. Pay attention to how many of its assets are kept offline in cold storage, how many times it’s been hacked , and whether it has private insurance.

FX Blue Live is a free web-based service for analyzing and publishing your trading results. You can analyze trades from MT4, MT5, cTrader, xOpenHub, Vertex FX, or FXCM TS2. The publisher has not provided information about accessibility.

- You’ll have access to all relevant statistics to take a real deep dive into your trading performance and make any changes needed to keep your edge as great as possible within the markets.

- Please allow additional time if international delivery is subject to customs processing.

- In this hands-on guide, IFC Markets explains what every new Forex trader should know about the currency markets.

- Perhaps the most popular option, mobile wallets are smartphone apps that help you access your crypto from any mobile device.

If you’re anything like me, you’re probably against paying for anything, right? Well, the full version only costs $19 per month and in all honesty for a professional trader, this is a great write off. You have access to all features and can literally sync your trading accounts, import all of your history and compile an in-depth trading journal to leverage. We introduce people to the world of currency trading, and provide educational content to help them learn how to become profitable traders. We’re also a community of traders that support each other on our daily trading journey.

In a diversified portfolio, currency movements tend to even out.

Take breaks from trading and occupy your mind with something else. Lead a healthy life with sports or at least walks and good food. From breaking news about what is happening in the stock market today, to retirement planning for tomorrow, we look forward to joining you on your journey to financial independence. It’s hard to predict which cryptocurrencies will remain and which will eventually vanish.

Yes, whenever you use crypto to make a purchase, you trigger a taxable event. The CRA will tax the difference between the cost basis of your crypto and the market value at the time of your purchase. Investors may have to pay an administrative or annual fee, a transaction fee, or withdrawal fees.

Digital Library Resources

With the current growth rate the market is projected to grow to more than $1.9 trillion per day by the year 2006. With such volume, one can assume that the Forex Market is extremely volatile, changing at a moment‘s notice, depending on conditions within that country. Candlesticks are a critical part of any technical trader’s arsenal.

Currency Trading for Dummies, 4th Edition

If it is an uptrend, meaning that the rate is increasing, buying the currency pair will give you a better probability for profit. If it is in a downtrend, meaning that the rate is decreasing, selling the currency pair will give you a better chance of making money. The simplest way to identify a trend is through the distinct patterns that the price forms. These can tell you if the market is moving in an uptrend or downtrend. When it comes to trading successfully and achieving consistent market-beating results, it is not about how much money you make but about how much money you keep. Please note that we are not authorized to provide any investment advice.

This accessible roadmap to trading mastery provides the foundational knowledge you need to create a structured, winning strategy and conquer the forex market. A small number of retailers will accept cryptocurrency as a form of payment. That means, investors can buy goods and services without exchanging crypto for CAD, which can save time roboforex review and money in fees. Hardware wallets store a private key on an external drive, which can help an investor access their crypto from multiple devices. Because hardware wallets are completely offline, they can help you safeguard your wallet from cyberattacks. For large crypto amounts, you may want to consider getting a hardware wallet.

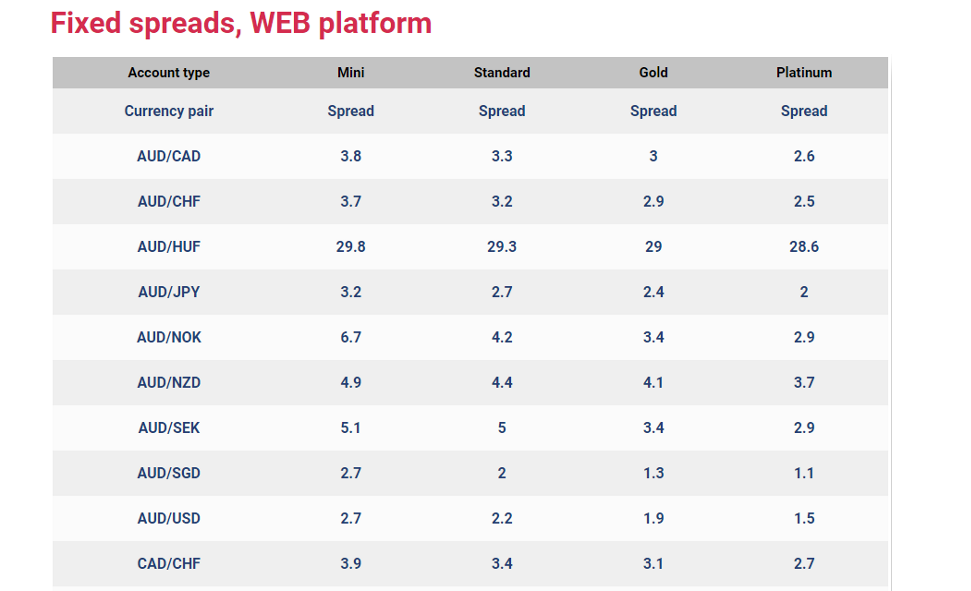

An alternative is the fixed spread account, where brokers set a specific mark-up, which remains unchanged, regardless of underlying market forces. Clifford Yew is an independent full-time trader for over 12 years. He has spent extensive time studying the trend and movement of the Foreign Exchange Market. Eventually, he has concluded that Price Action is simple technical yet effective in Foreign Exchange Market.

This book has been developed to help the forex beginners, though experienced and professional traders may find it a handy reference. This can include a more complex analytical approach, hedging your positions, using multiple entry and exit points, and cross-asset diversification. Offering guidance on the pitfalls of trading to be avoided and rules to manage various kinds of risks. Clear Entry Rules are based on specific indicators such as the MACD above the zero lines or not, and the entries are easy to identify and execute.